T4 deductions calculator

Income tax deducted of the T4 slip. Custom pay rules for deductions benefits and earnings.

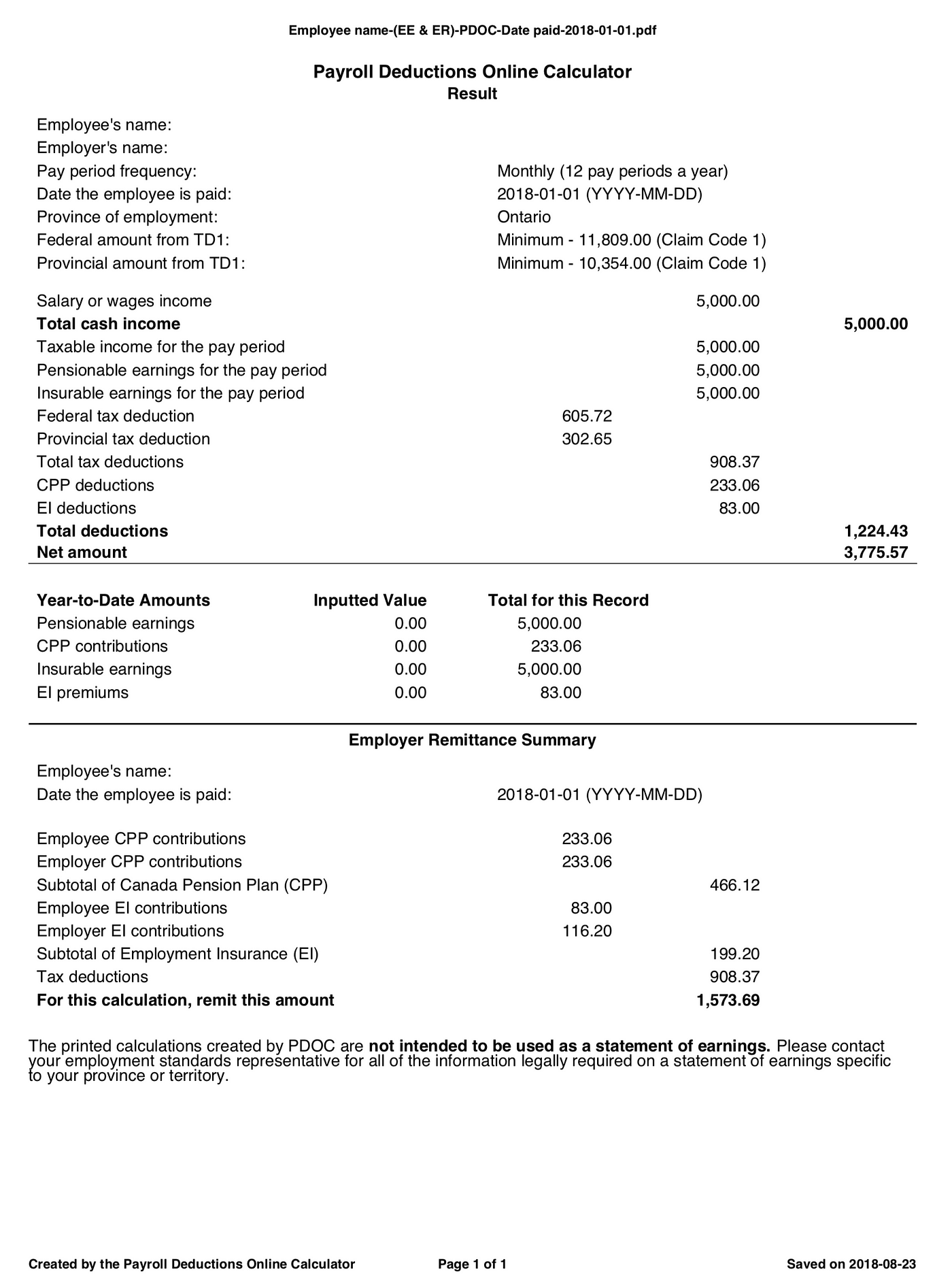

How To Calculate Payroll Deductions For Employee Simple Scenario By Sunray Liao Cpa Ca Medium

It calculates payroll deductions for the most common pay periods such as weekly or biweekly based on exact salary figures.

. Associates fresh MBA hire earn a 125000 salary 20000 signing bonus performance bonus of up to 40000 12 of bonussalary contributed to retirement fund2022 Salary Guide. Access anytime from any modern web browser. Net Pay 5000.

1350 and D2 Rs. Pricing Pricing Calculator Wagepoint App Status. About Us Careers Were.

Guide T4001 Employers Guide Payroll Deductions and Remittances. Paid time off public holidays. Reported on line 10100 of your tax return less any amounts included in lines 10105 10120 or 10130 which should be entered separately.

All thats required is the reporting of your self-employed or business income on form T2125 the Statement of Business or Professional Activities in addition to the reporting of your income on your T1 General. The good news is that filing as self-employed is not complicated. It really is fast and easy.

Gross Earnings 3561. Year-end T4T4As and reporting. 105000 were credited ultimately to the electronic credit ledger and D1 Rs.

Incomes overtime bonuses commissions etc. Employment income for which you receive a T4. 15750 and T4 Rs.

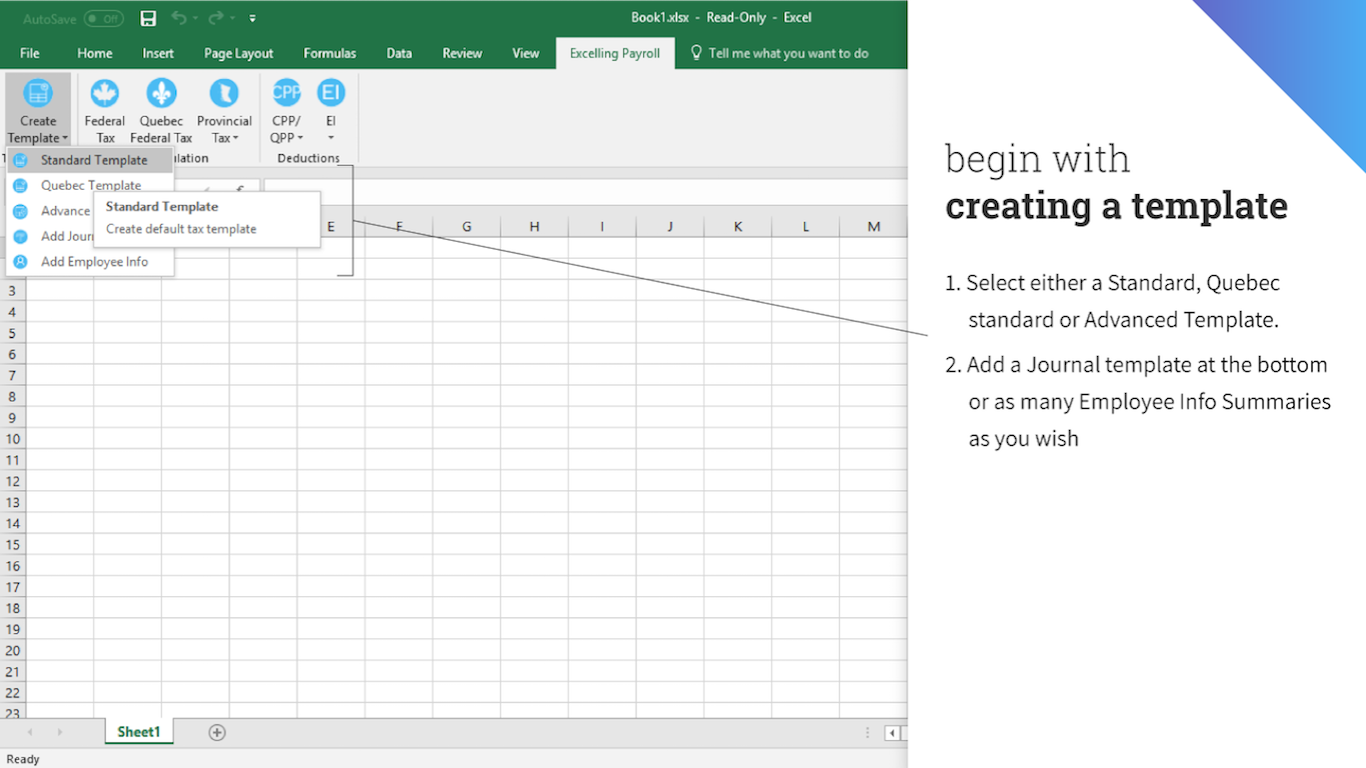

Guide T4130 Employers Guide Taxable Benefits and Allowances. Overall the best money and least expensive non-manual way of tracking your payroll system on the market. While many of their courses have a cost you can opt for the free versions of whatever courses you decide to take.

Remittance and reporting capabilities within Wagepoint vary by location. So out of the originally available ITC of Rs. Of the reversal ITC and reporting of the same in the relevant GST returns can be made simpler by trying out the smart.

Year-end tax slips T4 T4A RL-1 and summaries. Reports are easilty queried and printed. Deductions or benefits or override automatically.

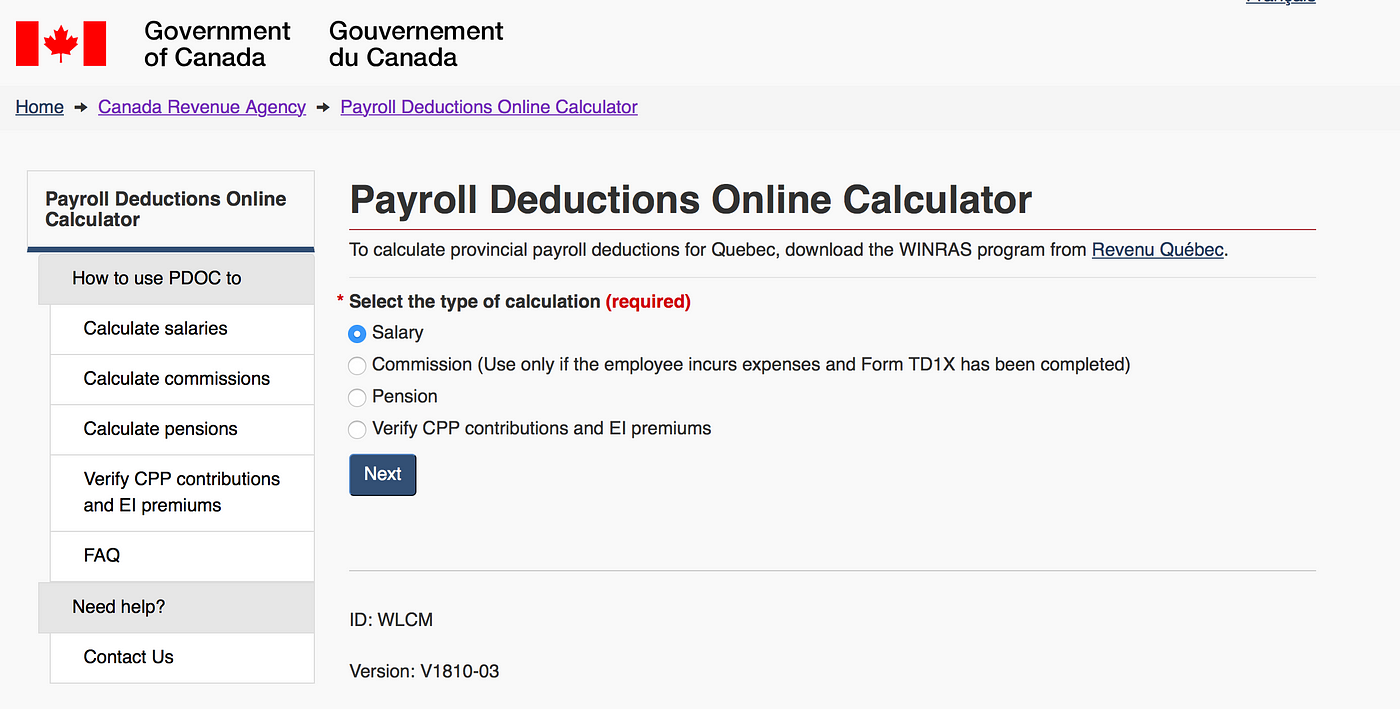

Use our quick tax calculator to find out your marginal tax rate and additional tax savings due to RRSP contribution. I think I got my returns in a. You can use our Payroll Deductions Online Calculator PDOC to calculate payroll deductions for all provinces and territories except Quebec.

T-4 Summary and Printable T-4s done at the click of a button. Jun 01 2022 The. Tax Filing Fast and Easy.

Children Education Allowance Hostel Allowance Miners Allowance Outstation Allowance Offshore Allowance etc are some of the special allowances. 900 were required to be reversed. Guide RC4157 Deducting Income Tax on Pension and Other Income and Filing the T4A Slip and Summary.

Use this free calculator to calculate child support according to the Canadian Child Support Guidelines. Deductions savings plan contributions health insurance etc. Small Businesses can benefit from the spreadsheets that track all source deductions for year end ease.

Calculating vacation pay in BC is not as easy as paying 8 hours at regular wage for reasons illustrated here but it is a pretty simple calculation just the sameOf course the simplest option is to try Payroll Connected for 30 days free and then let our software do all the heavy lifting for just 9 per month thereafterHowever for those not yet ready for the automated. Guide RC4120 Employers Guide Filing the T4 Slip and Summary. Guide RC4110 Employee or Self-employed.

This may result in an unwarranted. I look forward to using it every year. You can reduce the amount of business income that you earned because the CRA allows the.

Business analysts fresh out of undergrad hire earn a 75000 salary 5000 signing bonus 5000 relocation allowance. 150000 only C3 Rs. You can insert manually if it is different for each employee.

If you have even the littlest knowledge of taxes and deductions there is no better app. The template uses the following formula to calculate special allowance IFH40 ROUNDJ4-T4-1. Free Payroll Calculator Free Payroll Calculator 5000.

Always updated with latest tax tables - nothing to install. The e-learning site Coursera has a wealth of materials from colleges and universities around the globeTheir collection of accounting and bookkeeping courses is impressive.

How To Calculate Payroll Deductions Given A Hurdle In Excel Microsoft Office Wonderhowto

Payroll Calculator With Pay Stubs For Excel

Payroll Calculator Free Employee Payroll Template For Excel

Taxtips Ca Canadian Tax Calculator For Prior Years Includes Most Deductions And Tax Credits

2

Federal Income Tax Fit Payroll Tax Calculation Youtube

How To Prepare A T4 Slip In 12 Easy Steps Madan Cpa

How To Use The Cra Payroll Deductions Calculator Blog Avalon Accounting

A Payroll Calculator That Calculates Canadian Payroll Deductions Updated 2019

How To Calculate Payroll Deductions For Employee Simple Scenario By Sunray Liao Cpa Ca Medium

Calculating Payroll Deductions In Canada Humi Blog

Payroll Calculator Canada Apps On Google Play

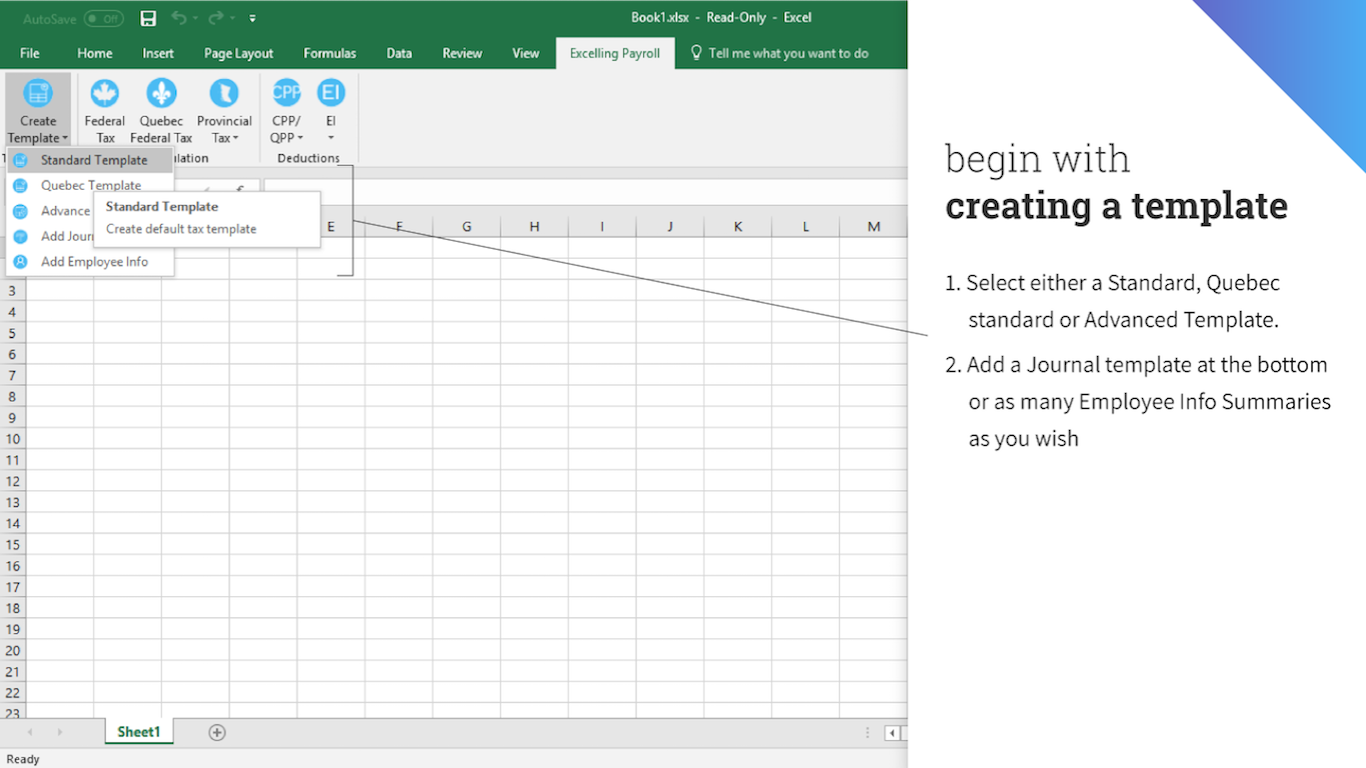

Find The Right App Microsoft Appsource

How To Use The Cra Payroll Deductions Calculator Blog Avalon Accounting

Online Payroll Calculator Payroll Connected

Opentaxsolver Payroll Deduction Calculator

How To Calculate Canadian Payroll Tax Deductions Guide Youtube